Hello, this is Andy.

This page contains promotional content.

How was your Golden Week?

I’ve heard that everywhere was packed with people! I’ve also heard that accommodations were charging 1.5 to 2 times their usual rates.

Well, when demand concentrates like that, prices go up—though I imagine the hotels are doing quite well.

Ideally, if holidays were spread out more evenly, both travelers and hotels would benefit. We've been hearing about the need to stagger holidays for years now, but it still hasn’t really happened, has it? ^^;

I suppose Japan won’t change anytime soon... although I do think personal long vacations will become more common.

Now then, I’d like to share the earnings results of Hilton, the global hotel group I’ve been keeping a close eye on.

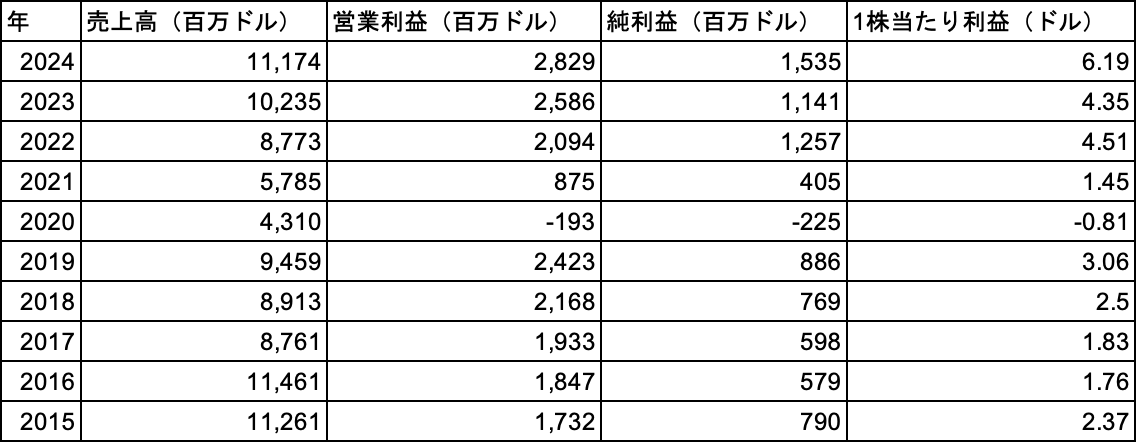

◯Past Earnings Summary

Following the COVID-19 pandemic, Hilton's profits have steadily recovered.

As a rebound from the pandemic, a global travel boom has emerged, and Hilton, as a major hotel chain, has seen a rapid recovery in its performance.

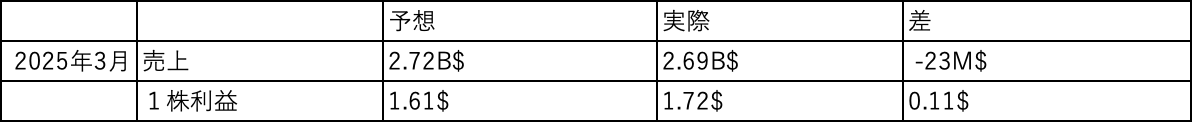

◯Q1 2025 (March) Earnings Information

While revenue fell short of expectations, profits have continued to grow steadily! If the current outlook holds, earnings are projected to increase in 2025 as well!

◯ Hilton Q1 FY2025 Earnings Summary (March Quarter)

■ CEO Comments – Christopher J. Nassetta (President & CEO)

“Despite a somewhat soft macroeconomic environment, we delivered strong bottom-line results and are pleased with our performance in the first quarter. Thanks to our industry-leading brands and powerful commercial engine, we expect continued solid net unit growth. Overall, we remain optimistic about our growth opportunities and confident in our ability to continue delivering value to our stakeholders beyond 2025.”

■ Q1 FY2025 Results (Three Months Ending March 31, 2025)

-

Comparable System-Wide RevPAR: +2.5% year-over-year (driven by increases in both occupancy and ADR)

-

Management & Franchise Fee Revenue: +5.1% YoY

-

Earnings Per Share (EPS):

-

GAAP: $1.23 (vs. $1.04 in Q1 FY2024)

-

Adjusted: $1.72 (vs. $1.53 in Q1 FY2024)

-

-

Net Income: $300 million

-

Adjusted EBITDA: $795 million

■ FY2025 Outlook

-

Comparable System-Wide RevPAR (ex-currency impact): Flat to +2% YoY

-

EPS Forecast:

-

GAAP: $7.04–$7.22

-

Adjusted: $7.76–$7.94

-

-

Net Income: $1.707–$1.749 billion

-

Adjusted EBITDA: $3.65–$3.71 billion

-

Capital Expenditures & Contract Acquisition Costs (excluding reimbursed amounts): $250–300 million

-

Shareholder Returns (e.g., share buybacks): ~$3.3 billion

-

General & Administrative Expenses: $420–430 million

-

Net Unit Growth Rate: 6.0%–7.0%