Hello, this is Andy. This page contains promotional content. Everyone, with spring approaching, have you made any travel or cherry blossom viewing plans?

In the U.S., there's a growing fear of a recession due to Trump's tariffs. If the U.S. enters a recession, Japan will undoubtedly be dragged into it as well. As a result, I imagine next spring's wage increases will be frozen or see only a slight rise.

When it comes to recessions, there seems to be a historical sequence:

- Stock prices fall.

- Economic indicators deteriorate significantly.

- Two consecutive quarters of negative GDP (recession) ... at this point, stock prices start to rise.

This shows that the actual economy and stock prices are correlated.

If the U.S. enters a recession, the cruise industry will likely suffer a considerable blow. However, there are no issues for fiscal year 2025 (cruises have advance bookings and prepayment systems), and bookings for 2026 are also extremely strong. Will Carnival face a recession in 2027???

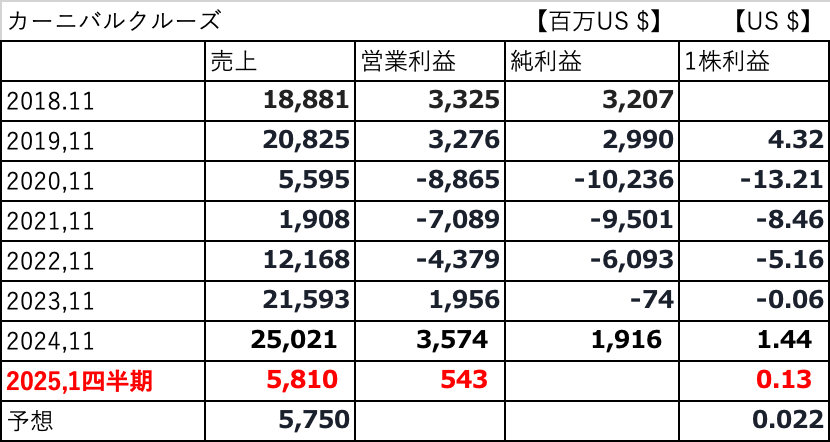

In fact, I'd like to share the results of the world's largest cruise company, Carnival Cruise's, first quarter 2025 earnings report, which was released yesterday.

○ First Quarter 2025 Earnings Report... It's extremely strong!

Well, I think it's a remarkably strong earnings report. Especially, the earnings per share have increased significantly. Other details are as follows:

The cumulative booking situation for the rest of the year matches the record levels of the previous year, and prices (taking exchange rates into account) have reached historical highs. Also, booking volumes for 2026 and beyond have reached record levels. They accelerated debt management, opportunistically restructured $5.5 billion in debt in the first quarter, achieving annual interest savings of $145 million, and reduced the debt balance by $500 million. The adjusted net profit guidance for 2025 is expected to increase by more than 30% compared to 2024, exceeding the December guidance by $185 million. This is attributed to improved revenue and expected interest expenses. The 2026 SEA Change financial goals are expected to be achieved one year ahead of schedule, with the 2025 adjusted return on invested capital (ROIC) and adjusted ALBD (Available Lower Berth Days EBITDA) expected to reach their highest levels in about 20 years.

They are steadily repaying the debt from the COVID-19 pandemic and have succeeded in significantly reducing interest payments. If this continues, Carnival Cruise is likely to resume dividends!

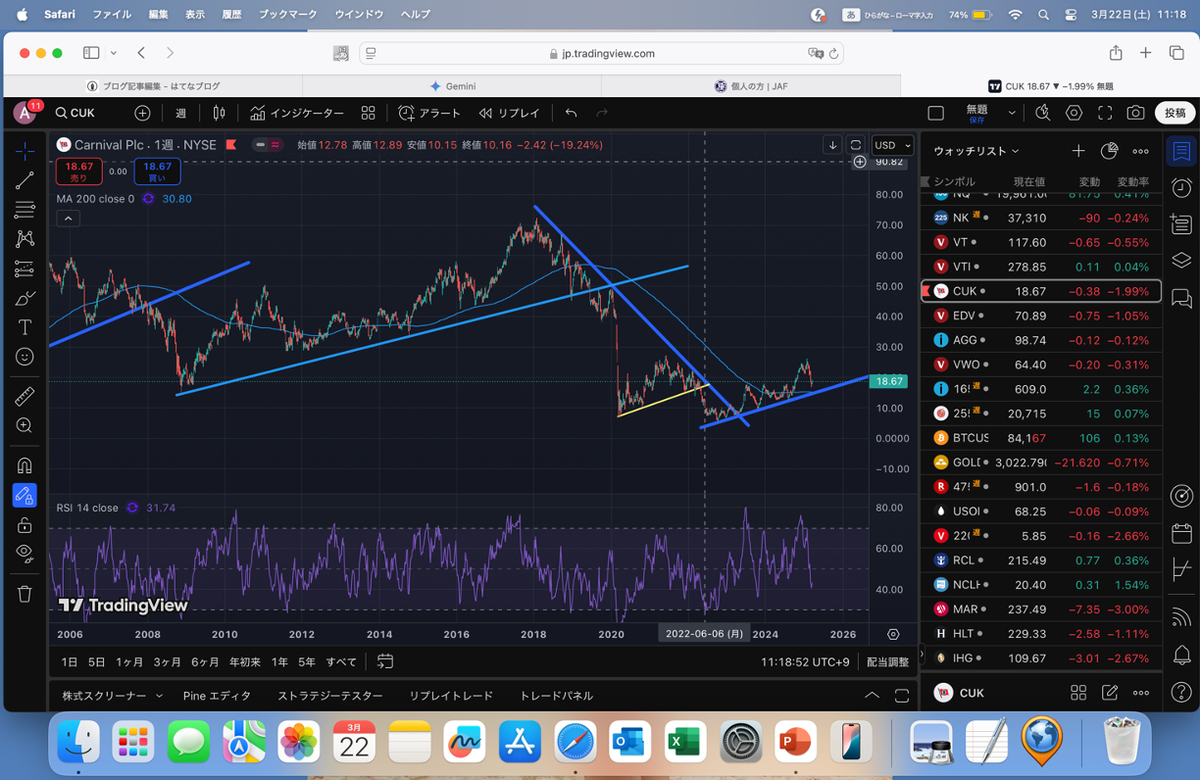

On the other hand, the stock price is in a correction phase. However, as it is rising step by step, I would like to continue to monitor its progress. Especially since the earnings per share are solid, I think this is a growth catalyst.