Hello, this is Andy.

This page contains promotions.

President Trump's tariffs have finally been implemented. As a result, global stock prices continue to decline ;;;;;

It seems that it will take a considerable amount of time for things, including supply chains, to stabilize.

Furthermore, inflation is also expected to progress, which raises the question: will interest rates remain high?

If interest rates stay high, the impact on the economy will be significant, increasing concerns about stagflation.

Well, let's see how things unfold... ;;;

Since this volatility is likely to continue, I want to set target stock prices as early as possible.

This time, the focus is on Wyndham Hotels & Resorts (WH).

Although this hotel group is not very familiar in Japan, it is a major global company.

Some of its key hotel brands include:

-

Ramada

-

Days Inn

-

Howard Johnson

-

Wyndham

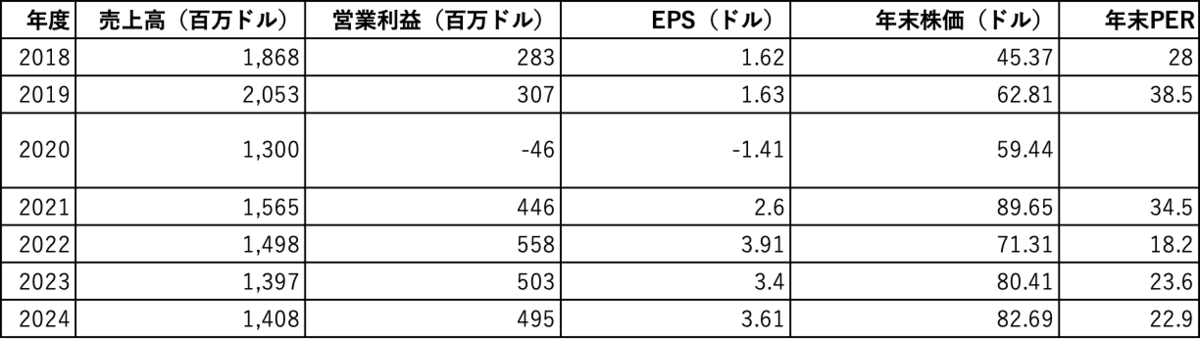

First, let’s take a look at the financial performance up to 2024.

During the COVID-19 pandemic, the company fell into the red, but from 2021 onwards, it made a V-shaped recovery, achieving per-share earnings that surpassed pre-pandemic levels.

From 2021 to the latest figures in 2024, the company has continued to steadily grow its revenue and profit.

Although it is hardly mentioned in Japan, it is a company that has been consistently increasing its profits.

Now, a major market crash will come sooner or later.

To prepare for that, I would like to establish a target stock price as a benchmark for deciding whether to buy.

The fundamental approach to setting this target stock price is based on the following book.

Basic Approach:

-

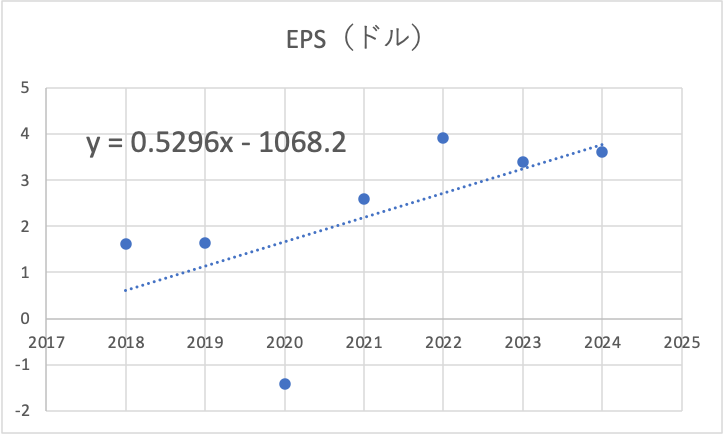

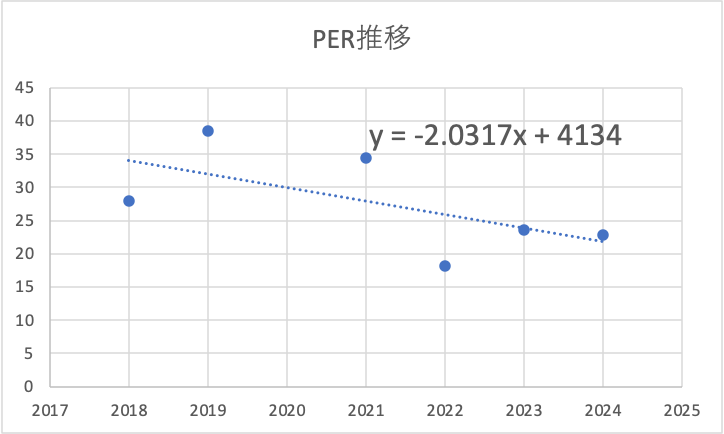

Estimate the EPS and PER for five years into the future based on past performance.

-

Use the projected EPS and PER to calculate the stock price, then set the target stock price at half of that value.

For Wyndham Hotels & Resorts, since it was spun off in 2018, relying solely on pre-COVID performance as a benchmark is challenging.

Therefore, for this analysis, I will calculate a reference target stock price that takes into account the entire COVID period.

2029 Forecast Values

-

Earnings per Share (EPS): 6.35

-

Price-to-Earnings Ratio (PER): 11.68

-

Stock Price Projection: 74

-

Target Stock Price: 37

-

Current Stock Price: 92

At this moment, stock price adjustments have already begun under the pretext of Trump's tariffs.

From the current stock price, a 60% decline would bring it down to $37.

A 60% correction would be on the scale of the Lehman Shock, but in the context of a major market crash, setting this as a target price seems reasonable.

That concludes my introduction to Wyndham Hotels & Resorts (WH) and the target stock price analysis.

During a major crash, everyone will likely panic. However, by setting target stock prices in advance, we can strengthen our grip on the situation and position ourselves to seize opportunities. I will continue refining target price settings for better preparation.