Hello, this is Andy.

This page contains promotional content.

Have you started planning and booking your summer vacation yet?

While domestic travel and inbound tourism were booming during Golden Week, it seems that overseas travel demand is still sluggish. Perhaps the weak yen is having a significant impact…

If you're thinking about traveling abroad for a good deal, early booking is highly recommended.

It looks like many people will be taking a 9-day summer holiday this year, from August 9 to August 17.

Now, let me share the Q1 FY2025 earnings report for Hyatt, which operates hotels in Tokyo, Kyoto, Osaka, Fukuoka, Kanagawa (Yokohama and Hakone), Ishikawa (Kanazawa), Okinawa, and Hokkaido (Niseko) in Japan.

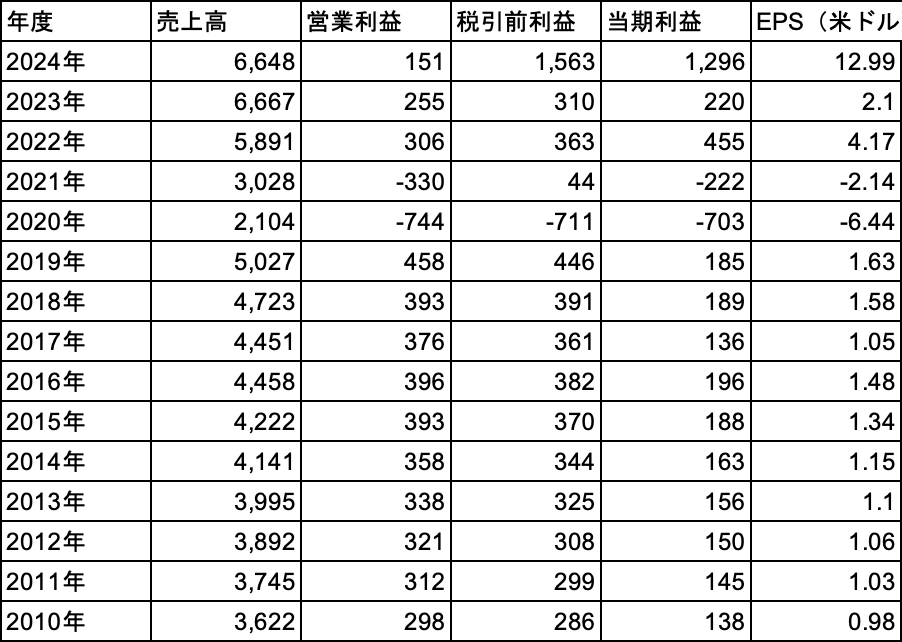

Hyatt's past performance is as follows:

Revenue has surpassed pre-COVID levels, but profits have yet to recover to those pre-pandemic figures.

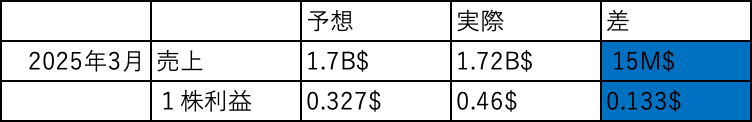

◯ Q1 FY2025 Earnings

Both revenue and earnings per share exceeded expectations. It can be said that the January–March period was exceptionally strong.

◯ CEO Hoplamazian’s Comment

“Despite increasing volatility in the economy and financial markets, we continue to deliver strong performance, as highlighted by our Q1 results. Looking ahead, due to recent shifts in booking patterns—particularly in short-term demand—we have modestly revised our outlook for the remainder of the year. That said, we remain confident in the resilience of our asset-light business model, the strength of our brand portfolio, and our ability to adapt to evolving market conditions. We are excited about the momentum in our development pipeline and the continued strong demand for our brands across the globe.”

Global premium asset-light business model companies like Marriott and Hyatt continue to perform very well!

Following the so-called "Trump Shock," I thought the previously booming travel industry might finally be impacted. However, Q1 results show absolutely no issues.

That said, the full-year outlook seems to tell a different story.

Marriott, operating in the premium zone, has reported no impact for the full year—so far.

Hyatt and companies in the volume zone appear to be feeling some effects.

The situation remains highly sensitive to the Trump Shock, but these kinds of market shocks can actually present great investment opportunities.

Though stock prices haven’t yet reached my target levels, I plan to patiently hold on until that time comes.