Hello, this is Andy.

This page contains promotional content.

How was your Golden Week?

I’ve been hearing from many that everywhere was packed with people. Some accommodations reported guest numbers 1.5 to 2 times higher than usual.

Ideally, if holidays were more evenly distributed, both travelers and accommodations could benefit. Although there's been talk for years about spreading out vacations, it doesn’t seem likely to happen anytime soon, does it? ^^;

Personally, I think Japan won’t change much in this regard... However, I do believe individually planned long vacations will continue to gain popularity.

As for me, I spent my time relaxing nearby with my family. I also took the opportunity to thoroughly read the new book about Elon Musk that was recently published.

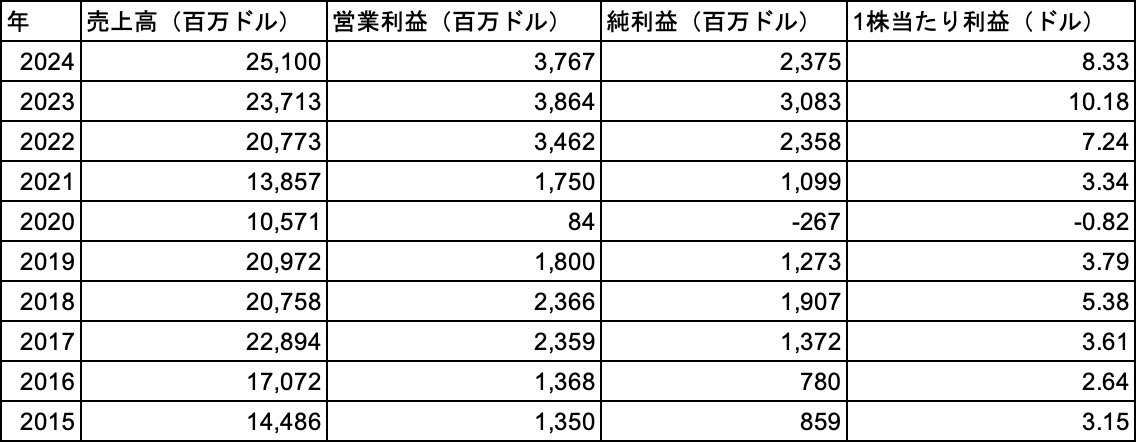

Now, as many of you probably know, the globally renowned hotel chain Marriott has released its financial results for the first quarter of fiscal year 2025. I’d like to share the highlights with you.

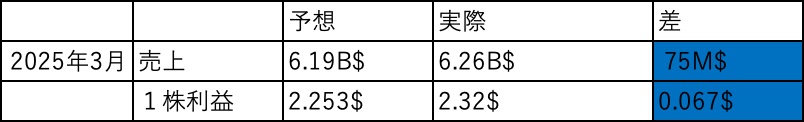

◯ Q1 FY2025 (March) Earnings Results

Strong performance!!! Both revenue and profit are steadily growing!

However, due to the global impact of the so-called "Trump Shock," the full-year profit outlook has been slightly revised downward.

◯ Q1 FY2025 (March) Earnings Highlights – Marriott

Solid Results!

Both revenue and profit continue to show steady growth!

However, due to the global impact of the so-called “Trump Shock,” the company slightly revised its full-year profit outlook downward.

-

Q1 2025 RevPAR increased by 4.1% globally and 3.3% in the U.S.

-

Diluted EPS for the quarter was $2.39, and adjusted diluted EPS was $2.32

-

Net income totaled $665 million, and adjusted net income was $645 million

-

Adjusted EBITDA came in at $1.217 billion

-

Approximately 12,200 net rooms were added during the quarter, a 4.6% increase from Q1 2024

-

At quarter-end, Marriott’s global development pipeline included nearly 3,800 projects with over 587,000 rooms, up 7.4% year-over-year

-

Marriott repurchased 2.8 million shares for $800 million in Q1 2025

→ As of April 29, total capital returns to shareholders exceeded $1.2 billion, including dividends and share buybacks

◯ Comments from Anthony Capuano, President & CEO

"Our strong first-quarter results reflect continued travel demand, the power of our brands, and the strength of our fee-based business model. Despite growing macroeconomic uncertainty, global RevPAR rose over 4%, driven primarily by increases in ADR, and development momentum remained positive.

International markets saw especially strong growth, with nearly a 6% increase in RevPAR led by double-digit gains in APEC. In the U.S. and Canada, RevPAR grew by over 3% in Q1, though growth slowed in March.

Development activity remained robust with a record 34,000 rooms signed during the quarter, two-thirds of which were in international markets. Conversions continue to be a key driver of growth, accounting for roughly one-third of both room signings and openings.

We remain committed to expanding our global portfolio and enhancing our offerings for guests, Marriott Bonvoy members, and hotel owners. Just last week, we announced an agreement to acquire the citizenMbrand, an innovative lifestyle lodging provider in the select-service segment. Given citizenM’s unique, differentiated positioning and our successful history of brand acquisitions such as AC Hotels, we’re excited about its global growth potential. Assuming the deal closes by year-end, we expect net rooms growth for full-year 2025 to approach 5%.

We’re also focused on expanding membership and deepening engagement with our industry-leading Marriott Bonvoy travel platform and loyalty program through exclusive experiences and partnerships. As of the end of March, Bonvoy membership had reached approximately 237 million members globally.

Despite macroeconomic uncertainties, we’re confident that the strength of our global portfolio, the power of Bonvoy, our dedicated associates, and our resilient asset-light business model position us well for sustainable, long-term growth."

As expected from Marriott, they continue to capture the upside of strong global travel demand with precision.

This remains a stock with strong growth potential, and one I’d look to buy during any significant market correction—keeping target price estimates in mind.