Hello, this is Andy.

This page contains promotional content.

President Trump’s tariffs have finally been implemented, and as a result, global stock prices continue to decline ;;;;;

It seems that it will take quite some time for things, including supply chains, to stabilize.

Additionally, inflation is also expected to continue, which raises the question: will interest rates remain high?

If interest rates stay high, the economic impact will be severe, increasing concerns about stagflation.

What will happen next…? ;;;

Given this ongoing market volatility, I believe it is important to set target stock prices in advance.

This time, I will focus on Choice Hotels International (CHH).

This hotel group may not be very well known in Japan, but it is a major company worldwide.

Here are some of its main hotel brands:

-

Comfort:

A mid-range hotel brand focused on comfort and reliability, catering to both business and leisure travelers. -

Quality Inn:

An economy hotel brand that offers affordable and comfortable stays, popular among cost-conscious travelers. -

Sleep Inn:

A mid-range hotel brand with a modern design and high-quality sleeping environments, ideal for travelers seeking a restful experience. -

Clarion:

A full-service hotel brand that accommodates meetings and events, making it suitable for business and group travel. -

Ascend Hotel Collection:

A premium hotel brand featuring independent and unique hotels, recommended for travelers looking for a distinctive stay experience. -

Cambria Hotels:

An upscale hotel brand with modern design and high-end amenities, perfect for stylish accommodations. -

MainStay Suites:

An apartment-style hotel brand catering to extended stays, offering a home-like experience for long-term travelers. -

WoodSpring Suites:

An economy apartment-style hotel brand for extended stays, ideal for budget-conscious long-term guests.

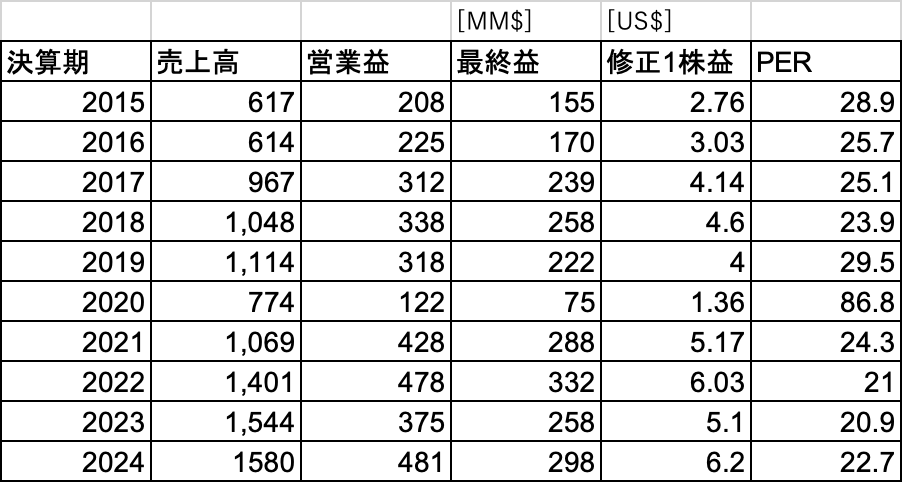

Now, let's take a look at the company's financial performance up to 2024.

It is truly remarkable that a company in the travel industry managed to stay profitable during the COVID-19 pandemic.

This is a noteworthy achievement.

Following that, the company has made a clean V-shaped recovery. Earnings per share (EPS) have been steadily increasing, surpassing pre-pandemic levels. This makes it a highly reassuring company.

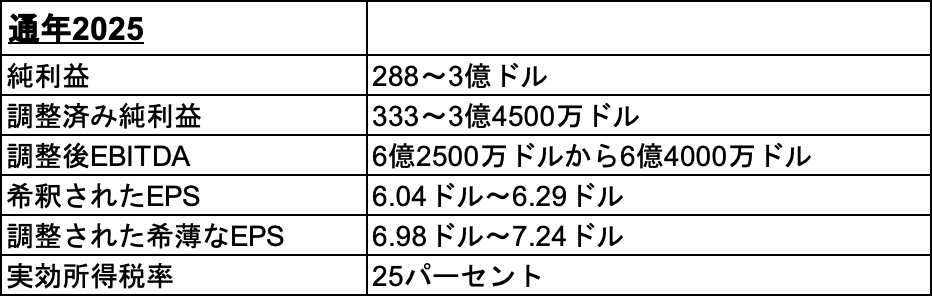

Based on the 2024 earnings results, the company has provided the following outlook for the future:

-

"Choice Hotels has once again delivered strong performance in 2024, exceeding the high end of our revenue guidance and achieving a 4.3% year-over-year net increase in our high-revenue domestic room portfolio. This is a testament to the success of our growth strategy," said President and CEO Patrick Pacious.

-

"In 2024, we successfully relaunched four brands, significantly expanded our partnership business, greatly increased our international footprint, achieved record organic growth in our rewards program, and unlocked new value through additional ancillary revenue opportunities. As we enter 2025, we will realize revenue growth from past investments, meaningfully scale our operations, and accelerate growth over the coming years."

-

Target financial indicators for FY2025

EPS is expected to increase by more than 10% compared to 2024! This likely reflects the strong demand, including advanced bookings.

Now, when considering the best time to buy Choice Hotels International, a market downturn could present an excellent opportunity.

The fundamental approach to this strategy is based on the following book:

The Fundamental Approach is as Follows:

-

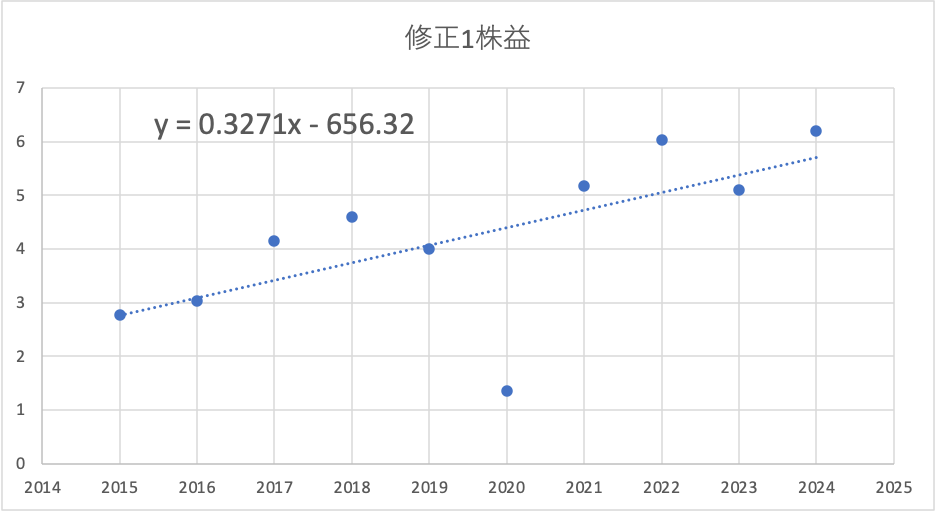

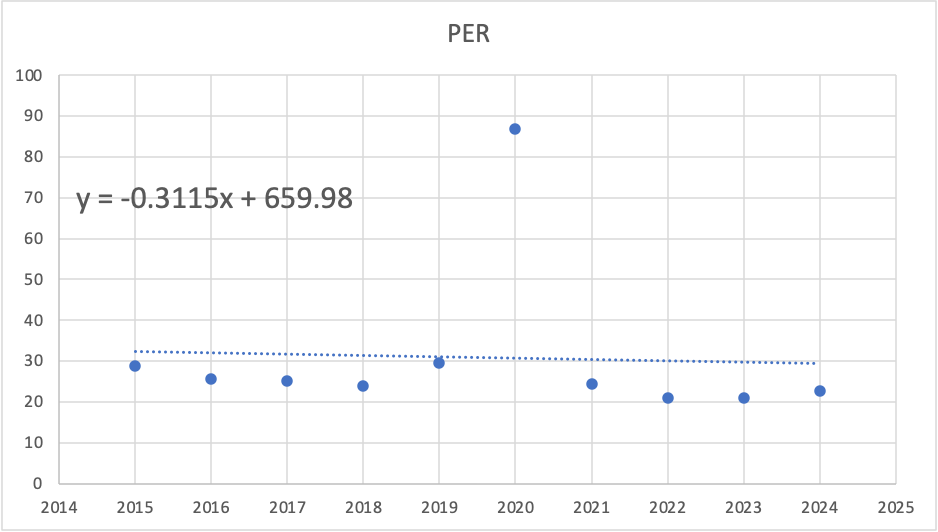

Estimate the EPS and PER for five years into the future based on past performance.

-

Use these projected EPS and PER to estimate the future stock price, then set the target stock price at half of that estimate.

Forecasting FY2029 Performance Based on the Above Trends

FY2029 Performance Forecast

-

EPS: 7.365

-

PER: 27.9

-

Stock Price: 205

-

Target Stock Price: 102.7

The current stock price of Choice Hotels International is $133.

A 23% decline would bring it down to the target stock price.

A 23% drop occurs every few years, making it a highly plausible scenario.

If such a downturn happens, it could be the perfect buying opportunity for Choice Hotels International stock!