Hello, this is Andy.

This page contains promotional content.

Everyone, do you see blood in the streets? Can you take action when there's blood in the streets?

That’s a famous quote from the Rothschild family.

Indeed, this so-called “Trump Shock” has had a huge impact.

But if we look at the situation calmly, the countries that were already in trade conflicts with the U.S. are retaliating, while others are moving toward negotiation.

The United States controls about 60% of the world’s financial markets. If the U.S. stock market collapses, the global economy would collapse as well.

Assuming that won't be allowed to happen, U.S. stock indexes should remain solid. That means every dip is a buying opportunity!

If U.S. finance fails, the world fails.

China, the world's second-largest economy, accounts for only about 7% of the global financial system—on par with Japan.

In terms of financial dominance, the U.S. stands out overwhelmingly. So the idea of investing while excluding the U.S.? That's hard to justify.

With that in mind, here's my current stance on the Trump Shock:

-

First, hold all current index positions. Hold tight!

-

At some point, consider buying when the S&P 500 hits its 200-week moving average.

-

For individual stocks, look at hotel stocks and consider purchasing based on re-evaluated target prices.

-

As gold prices tend to move inversely, be prepared to sell some during an economic downturn.

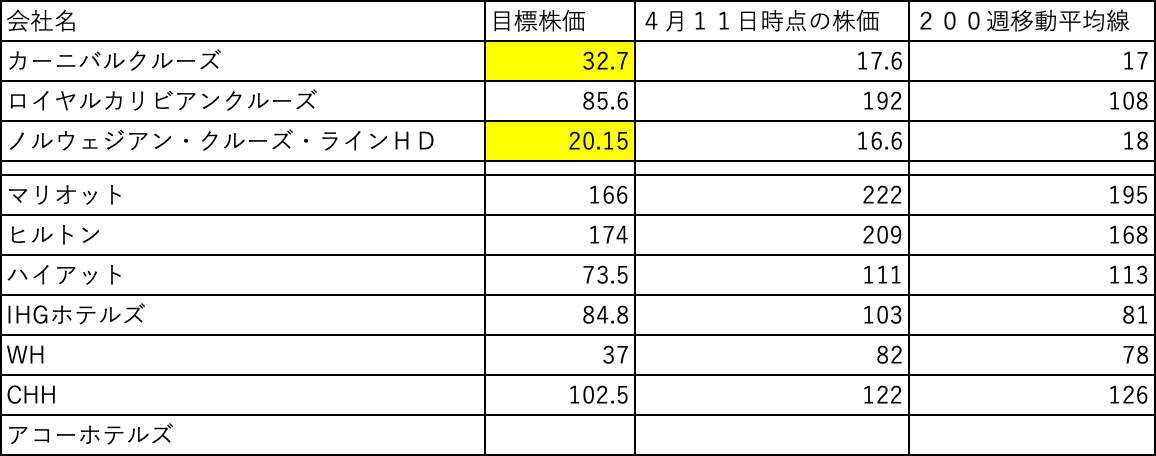

Now, let’s go ahead and recheck the target stock prices we've been reviewing so far.

Hotel Info ⑦ — Accor Hotels Target Price Currently Under Review

Now then, let’s evaluate the current target prices.

① Cruise Sector

Carnival and Norwegian have dropped to their target prices!

It seems like the 200-week moving average is acting as a support line. This looks promising.

I’m still considering how much more of Carnival to add to my holdings—

But I’m leaning toward adding more hotel stocks instead.

② Hotel Sector

These haven’t dropped much yet.

It feels like they’re bouncing off the 200-week moving average as a support level.

Buying at that support line could be one strategy, but I think I’ll wait and watch a little longer.

③ U.S. Economy

So far, it’s just stock prices that have gone down — economic indicators haven’t gone off the rails yet.

I plan to re-evaluate target prices and consider buying again when the next round of economic indicators really start to look bad.

Stock price drop → Economic data turns ugly → Recession

(At that point, stock prices likely hit bottom.)

It still feels a bit too early to start buying.

I’d prefer to wait until U.S. economic indicators become significantly worse.